This will help to organize and classify the cost data in a consistent and logical manner. For example, if the cost report is for a construction project, then some of the relevant cost categories may be site preparation, foundation, framing, roofing, plumbing, electrical, etc. And some of the relevant cost subcategories may be excavation, concrete, steel, wood, tiles, pipes, wires, etc. This information is summarized nicely in a standard format with the production cost report. Conversion costs refer to the direct labor and manufacturing overhead expenses incurred in the production process to convert raw materials into finished goods.

Would you prefer to work with a financial professional remotely or in-person?

The company then used this information to implement corrective actions, such as improving inventory management, optimizing machine settings, training and motivating workers, and enforcing quality standards. As a result, the company was able to reduce variance costs by 25%, what is payback period improve product quality by 15%, and increase customer satisfaction by 20%. The cost reporting system also helped the company to evaluate the profitability and competitiveness of each part, and to make informed decisions about pricing, product mix, and market segments.

What are the main differences between Process Costing and job-order costing?

- This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

- If a product is more expensive to produce but offers unique benefits, marketing can craft messages that justify the premium price.

- The cost of production encompasses all expenses incurred to bring a product to market, including raw materials, labor, and overhead.

- It provides insights into the production process by outlining direct materials, direct labor, and manufacturing overhead costs, allowing businesses to analyze their efficiency and cost-effectiveness.

- The cost reporting system enabled the company to identify the sources and causes of variance, such as material waste, machine downtime, labor inefficiency, and quality issues.

However, if thecompany produces more or fewer units than were produced in May, theunit cost will change. This is because the $62 unit cost includesboth variable and fixed costs (see Chapter 5 for a detaileddiscussion of fixed and variable costs). By considering these points, a comprehensive understanding of direct materials and labor costs can be achieved. The insights gained from these calculations are instrumental in making informed decisions regarding production strategies and financial management. From a financial perspective, analyzing cost data helps in assessing the overall financial health of a business. By examining cost trends over time, financial analysts can identify cost drivers, such as changes in raw material prices or labor costs, and evaluate their impact on the company’s financial performance.

“Production cost report” also found in:

Who are the intended audience and what are their expectations and needs? Answering these questions can help to determine the format, structure, and content of the cost report. A healthcare organization that used cost reporting to optimize the allocation and utilization of resources and staff. A baseline is a reference point that shows the original plan, budget, and schedule of the project. A contingency plan is a backup plan that accounts for the potential risks, uncertainties, and changes that may affect the project. Having a baseline and a contingency plan will help to measure the actual performance and variance of the project, as well as to adjust the plan and budget accordingly.

Creating a Cost Report Structure

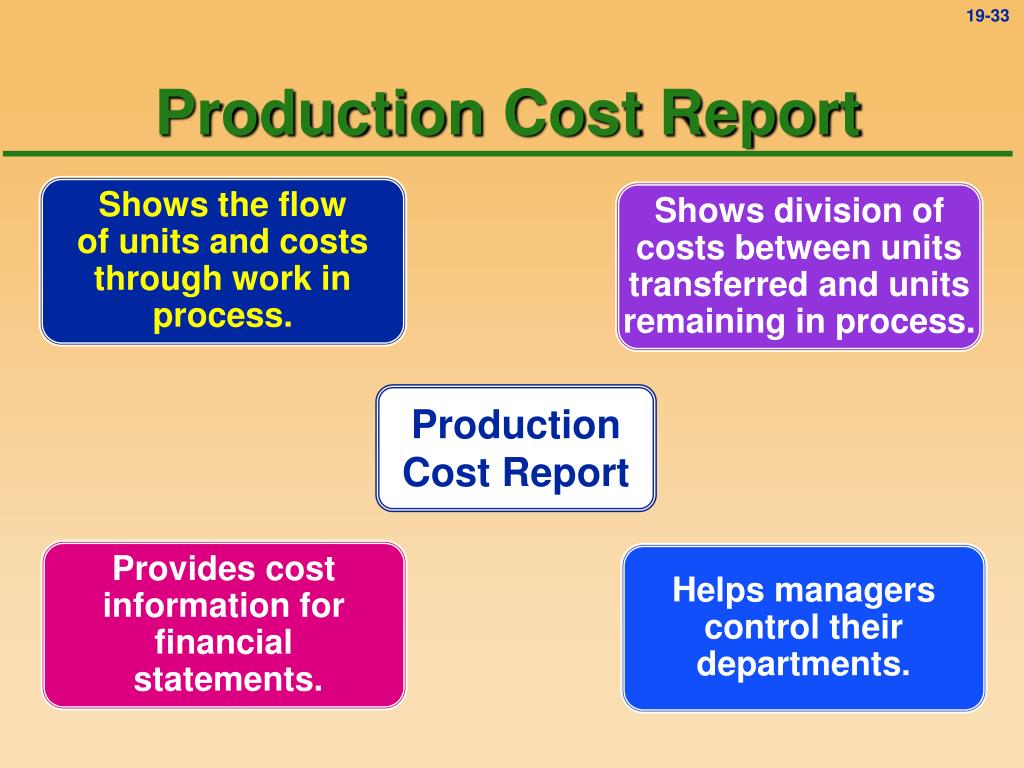

The four key steps of assigning costs to units transferred out and units in ending WIP inventory are formally presented in a production cost report . The production cost report summarizes the production and cost activity within a processing department for a reporting period. Rounding the cost per equivalent unit to the nearest thousandth will minimize rounding differences when reconciling costs to be accounted for in step 2 with costs accounted for in step 4. Understanding the Cost of Goods sold (COGS) is pivotal in grasping the full picture of a manufacturing entity’s financial health. This metric reflects the direct costs attributable to the production of the goods sold by a company. It includes material costs, direct labor, and overhead directly tied to the production process.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Asset restructuring is a process of changing the composition or structure of your assets to improve… Expense recognition is a cornerstone of accrual accounting, which dictates that expenses should be… Chapter 11 of the Bankruptcy Code stands as a beacon of hope for businesses that find themselves…

A retail chain that used cost reporting to analyze and improve the performance and profitability of different stores and departments. This means gathering the relevant and accurate data from various sources, such as invoices, receipts, timesheets, contracts, etc. The data should be categorized and classified according to the cost breakdown structure (CBS), which is a hierarchical representation of the different types of costs involved in the project or business. For example, a CBS for a software development project may include categories such as labor, hardware, software, travel, etc. An example of how to use Excel to prepare a production cost report follows.

The cost report should also include a summary, an introduction, a body, and a conclusion, as well as a title page, a table of contents, and an appendix. For example, a cost report for a government contract may have a different format and style than a cost report for a private client. By integrating cost of production data into strategic decision-making, companies can create a robust framework for operational excellence and long-term profitability. This data-driven approach enables a proactive stance, allowing businesses to anticipate changes and adapt swiftly in a dynamic market landscape.

For the iPhone 16 Pro, the M14 display is priced at $110 (Rs 9,300 approximately), with camera components at $91 (Rs 7,700 approximately). The report also claims that Google’s production cost for the Pixel 9 Pro is reportedly around 11 per cent less than that of the Pixel 8 Pro. That said, it is important to note that the comparison may not be that simple, considering the Pixel 9 Pro also features a smaller display and battery than the Pixel 8 Pro. From the viewpoint of a production manager, WIP Inventory is a hands-on measure of production flow. High levels of WIP can indicate inefficiencies or issues with machinery, labor, or supply chain management. Conversely, too little WIP might suggest a lack of demand or problems with upstream suppliers.

The presentation should use a logical and coherent flow to tell a story and convey a message. The presentation should also use a professional and engaging tone and language to capture the attention and interest of the audience. Starting a nonprofit can be a fulfilling way to make a difference in the community, but it requires careful planning and consideration. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Recent Comments