The interpretation of the value of the current ratio (working capital ratio) is quite simple. As it is significantly lower than the desirable level of 1.0 (see the paragraph What is a good current ratio?), it is unlikely that Mama’s Burger will get the loan. Get instant access to video lessons taught by experienced investment bankers.

Increase Current Assets – Ways a Company Can Improve Its Current Ratio

For example, a declining current ratio could indicate deteriorating liquidity, while an increasing current ratio could indicate improved liquidity. It’s particularly useful when assessing the short-term financial health of potential investment opportunities. This ratio, however, should not be viewed in isolation but rather as part of a holistic financial analysis.

Operational Efficiency – Why Is the Current Ratio Important to Investors and Stakeholders?

- However, because the current ratio at any one time is just a snapshot, it is usually not a complete representation of a company’s short-term liquidity or longer-term solvency.

- Current assets, which constitute the numerator in the Current Ratio formula, encompass assets that are either in cash or will be converted into cash within a year.

- Because inventory levels vary widely across industries, in theory, this ratio should give us a better reading of a company’s liquidity than the current ratio.

- Learn how to build, read, and use financial statements for your business so you can make more informed decisions.

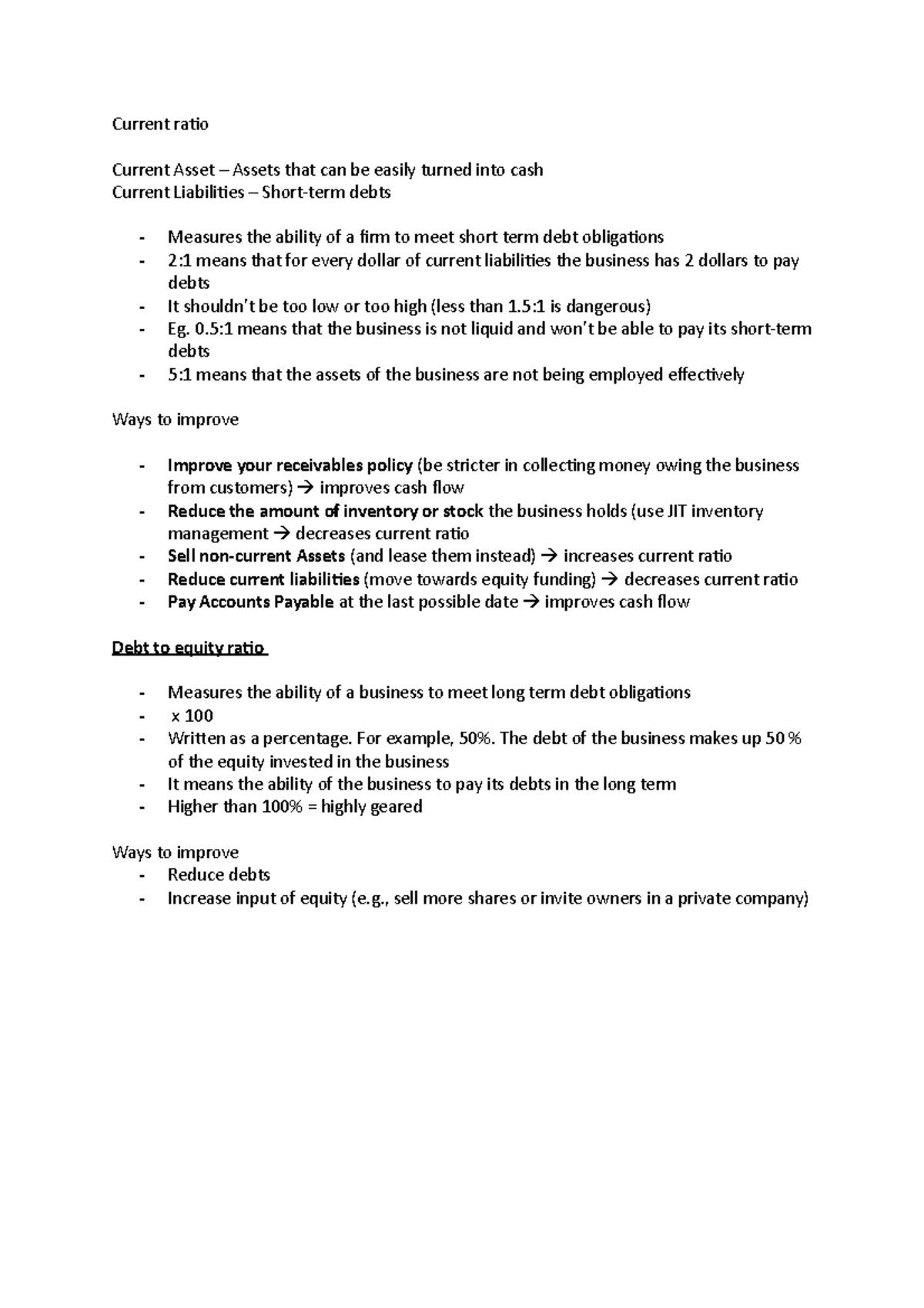

On the other hand, a current ratio below 1 may indicate that a company may have difficulty paying its short-term debts and obligations. It is important to note that the current ratio is just one of many financial metrics that should be considered when evaluating a company’s financial health. Putting the above together, the total current assets and total current liabilities each add up to $125m, so the current ratio is 1.0x as expected. To measure solvency, which is the ability of a business to repay long-term debt and obligations, consider the debt-to-equity ratio. It measures how much creditors have provided in financing a company compared to shareholders and is used by investors as a measure of stability.

How Is the Current Ratio Calculated?

However, the quick ratio excludes prepaid expenses and inventory from the assets category because these can’t be liquified as easily as cash or stocks. With both values in hand, one can proceed to calculate the current ratio by dividing the total current assets by the total current liabilities. On the other hand, companies in industries with low inventory turnover, such as technology, may have higher current ratios due to the high value of cash and other liquid assets on their balance sheets. The current ratio can also analyze a company’s financial health over time. Let’s say that Company E had a current ratio of 1.5 last year and a current ratio of 2.0 this year. This suggests that Company E has improved its ability to pay its short-term debts and obligations over the past year.

Our Team Will Connect You With a Vetted, Trusted Professional

Ratios lower than 1 usually indicate liquidity issues, while ratios over 3 can signal poor management of working capital. These are future expenses that have been paid in advance that haven’t yet been used up or expired. Generally, prepaid expenses that will be used up within one year are initially reported on the balance sheet as a current asset.

A higher current ratio indicates that a company can easily cover its short-term debts with its liquid assets. Generally, a current ratio above 1 suggests financial stability, while a ratio below 1 may signify potential liquidity problems. The current ratio is a vital financial metric that assesses a company’s ability to cover its short-term debts using its most liquid assets. To properly analyze the current ratio, it’s essential to understand its components, consisting of current assets and current liabilities. Being a liquidity ratio, it compares a company’s current assets, which are convertible into cash within a year, with its current liabilities, which must be paid off within the same period.

The current ratio (also known as the current asset ratio, the current liquidity ratio, or the working capital ratio) is a financial analysis tool used to determine the short-term liquidity of a business. It takes all of your company’s current assets, compares them to your short-term liabilities, and tells you whether you have enough of the former to pay for the latter. The current 10 key bookkeeping tips for self-employed and freelancers ratio is a liquidity measurement used to track how well a company may be able to meet its short-term debt obligations. Measurements less than 1.0 indicate a company’s potential inability to use current resources to fund short-term obligations. A company’s current assets include cash and other assets that the company expects will be converted into cash within 12 months.

Suppose we’re tasked with analyzing the liquidity of a company with the following balance sheet data in Year 1. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. However, similar to the example we used above, special circumstances can negatively affect the current ratio in a healthy company.

The denominator in the Current Ratio formula, current liabilities, includes all the company’s short-term obligations, i.e., those due within one year. It encompasses items such as accounts payable, short-term loans, and any other debts requiring repayment in the near future. In the dynamic world of finance, it’s essential to navigate the complexities of financial ratios. Today, we unravel the ‘Current Ratio,’ a key metric used to assess a company’s financial health. Ratios in this range indicate that the company has enough current assets to cover its debts, with some wiggle room.

Recent Comments